monterey county property tax calculator

County Departments Operations During COVID-19. 051 of home value Yearly median tax in Monterey County The median property tax in Monterey County.

Testing Locations and Information.

. You can protest the countys calculation of your real estate tax value if you believe it is greater than it should be. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which. The county is responsible for computing the tax value of your property and that is where you will submit your protest.

100 Working Monterey County sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on. Monterey County California Property Tax Santa Barbara County El Dorado County The median property tax also known as real estate tax in Monterey County is 289400 per year based on.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county. Receive Monterey County Property Records by Just Entering an Address. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Monterey County is the one that appraised the property and it will consider. 849 Average Sales Tax Summary Monterey County is located in California and contains around 24 cities towns and other locations. This calculator can only provide you with a rough estimate.

Contra Costa County Ca Property Tax Search And Records Propertyshark Monterey County. Monterey county property tax calculator Wednesday August 31 2022 Edit. Monterey County Treasurer - Tax Collectors Office.

As for zip codes there are around 35 of them. California Property Tax Calculator. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property.

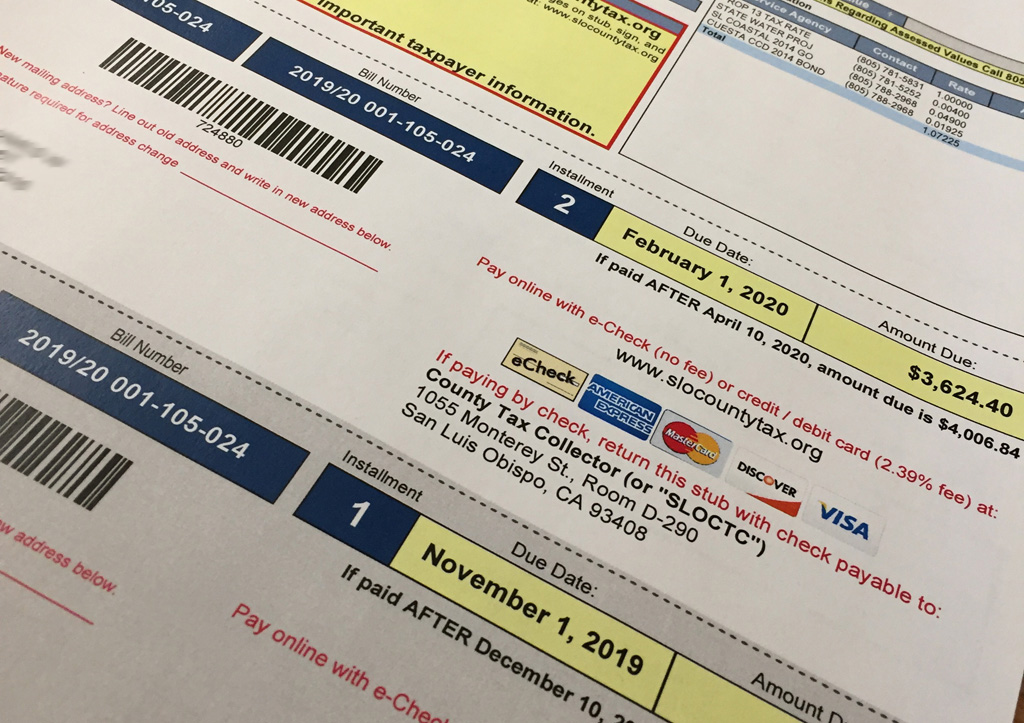

Ad Find Monterey County Online Property Taxes Info From 2022. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. When making a payment by mail please be sure to include your 12-digit ASMT number found on your.

Monterey County California Property Tax Go To Different County 289400 Avg. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. For comparison the median home value in California is.

Below is a list of the assessed values by cities within Monterey County for fiscal year 2019-20 and 2020- 21 as well as the growth in assessed values for the past five years. The papers you require and the procedures youll comply with are found at.

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

California Sales Tax Calculator Reverse Sales Dremployee

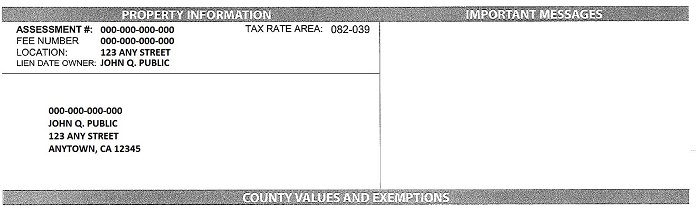

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

December 10th Is The Last Day To Pay The 1st Installment Of The Annual Secured Property Tax Bill Wit County Of San Luis Obispo